Social Security Check is now called “Federal Benefit Payment”

The government is now referring to our Social Security checks as a “Federal “Benefit” Payment.” This isn’t a benefit. It is our money paid out of our earned income! Not only did we all contribute to Social Security but our employers did too. It totaled 15% of our income before taxes.

If you calculate the future value of your monthly investment in social security ($375/month, including both you and your employers contributions) at a meager 1% interest rate compounded monthly, after 40 years of working you’d have more than $1.3+ million dollars saved!

This is your personal investment. Upon retirement, if you took out only 3% per year, you’d receive $39,318 per year, or $3,277 per month. Are you getting that???

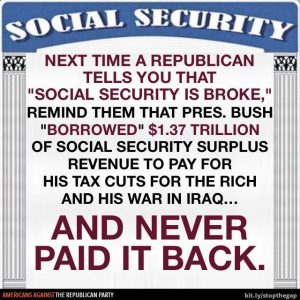

Instead, the folks in Washington pulled off a bigger “Ponzi scheme” than Bernie Madoff ever did. They took our money and used it elsewhere. They forgot (oh yes, they knew) that it was OUR money they were taking. They didn’t have a referendum to ask us if we wanted to lend the money to them. And they didn’t pay interest on the debt they assumed. And recently they’ve told us that the money won’t support us for very much longer.

READ MORE

VLA Comment: Ask your representative to deal with this!!! The renaming of this as a “benefit” is a slight of linguistic hand…It is not a “benefit” that the Government can issue or withdraw…IT IS OUR MONEY WE SAVED, be held by the government… that we and our employer put in the the hopper to support our senior years.